Little Known Facts About Mortgage Broker Salary.

Wiki Article

Some Of Mortgage Broker Association

Table of ContentsThe Best Strategy To Use For Broker Mortgage RatesSome Of Mortgage Broker Average SalaryWhat Does Broker Mortgage Fees Do?Broker Mortgage Rates Things To Know Before You BuyMortgage Broker Association for BeginnersHow Broker Mortgage Meaning can Save You Time, Stress, and Money.How Mortgage Broker Assistant can Save You Time, Stress, and Money.Mortgage Broker Job Description Things To Know Before You Buy

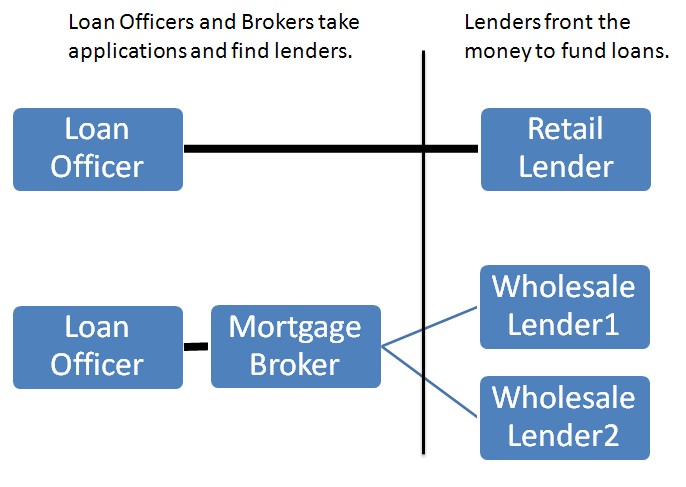

A broker can contrast finances from a financial institution and also a credit score union. According to , her first duty is to the establishment, to make certain lendings are properly protected and the borrower is totally certified and also will make the lending payments.Broker Commission A home loan broker represents the debtor more than the lending institution. His responsibility is to obtain the customer the most effective deal possible, no matter the organization. He is usually paid by the car loan, a kind of payment, the distinction in between the rate he receives from the loan provider and the price he provides to the customer.

Mortgage Broker Assistant - Truths

Jobs Defined Knowing the advantages and disadvantages of each may help you make a decision which career path you intend to take. According to, the major difference in between the two is that the bank home mortgage police officer represents the products that the financial institution they function for deals, while a home loan broker deals with multiple lending institutions and serves as a middleman between the loan providers and also client.On the other hand, bank brokers might locate the job ordinary after a while since the procedure generally remains the very same.

The Facts About Mortgage Broker Assistant Uncovered

What Is a Lending Policeman? You might recognize that locating a car loan officer is an essential action in the process of acquiring your financing. Let's discuss what lending officers do, what knowledge they require to do their job well, and also whether financing police officers are the very best choice for borrowers in the car loan application screening process.

Getting My Mortgage Brokerage To Work

What a Lending Officer Does, A car loan policeman helps a bank or independent loan provider to aid customers in using for a financing. Because lots of customers function with car loan officers for home mortgages, they are typically referred to as home mortgage loan policemans, though numerous funding police officers assist customers with other fundings.If a funding police officer thinks you're qualified, then they'll suggest you for authorization, and you'll be able to proceed on in the process of obtaining your loan. What Car Loan Officers Know, Car loan police officers must be able to function with consumers and also tiny service owners, and they should have substantial expertise regarding the market.

The Facts About Mortgage Broker Assistant Job Description Revealed

4. Exactly How Much a Lending Officer Costs, Some funding police officers are paid through compensations. Home loan tend to result in the largest compensations because address of the size as well as workload related to the finance, yet compensations are often a flexible pre paid charge. With all a finance officer can do for you, they tend to be well worth the cost.Financing police officers understand everything about the lots of kinds of fundings a lender might offer, as well as they can offer you suggestions regarding the most effective option for you and also your circumstance. Discuss your requirements with your loan policeman. They can assist route you towards the very best car loan type for your circumstance, whether that's a traditional lending or a jumbo finance.

Mortgage Broker Assistant - The Facts

2. The Duty of a Lending Officer in the Testing Refine, Your financing policeman is your direct contact when you're getting a financing. They will certainly investigate and also review your financial background and assess whether you qualify for a mortgage. You won't need to stress over regularly speaking to all the people involved in the useful content home loan procedure, such as the underwriter, realty agent, negotiation attorney as well as others, because your loan policeman will certainly be the point of get in touch with for every one of the entailed parties.Because the process of a funding purchase can be a facility and also pricey one, several consumers prefer to deal with a human being instead of a computer system. This is why financial institutions might have a number of branches they wish to serve the prospective borrowers in numerous locations who wish to meet in person with a funding policeman.

The Single Strategy To Use For Mortgage Broker

The Duty of a Lending Officer in the Finance Application Process, The home mortgage application process can really feel frustrating, particularly for the novice buyer. When you work with the ideal finance policeman, the procedure is in fact pretty basic. When it comes to requesting a mortgage, the process can be broken down right into 6 stages: Pre-approval: This is the phase in which you find a loan police officer and obtain pre-approved.Throughout the lending processing stage, your finance policeman will call you with any type of inquiries the car loan processors might have regarding your application. Your loan policeman will certainly after that pass the application on to the underwriter, who will certainly examine your credit reliability. If the expert accepts your loan, your lending officer will then collect and prepare the appropriate lending closing records.

The 9-Second Trick For Broker Mortgage Calculator

Exactly how do you pick the ideal financing policeman for you? To start your search, start with loan providers that have an excellent credibility for exceeding their clients' look at these guys assumptions as well as maintaining industry standards. As soon as you have actually selected a loan provider, you can then start to limit your search by talking to funding police officers you may wish to deal with (mortgage broker association)./mortgage-broker-3b0953175a7e4d90b99e937b79e0cd14.jpg)

Report this wiki page